THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Is studying find out how to turn into wealthy and never having to fret about cash a dream of yours?

I’ve talked to lots of people who’ve this dream (together with myself).

After working with many profitable millionaires and speaking to tons of of individuals, I’ve provide you with a plan.

No, this isn’t a get-rich-quick scheme for the following nice funding.

It’s a 15 step monetary plan to get you to begin constructing wealth and attain monetary independence.

If you happen to comply with these easy steps to realize wealth, you’ll be shocked at how one can reside a lifetime of wealth past your wildest goals.

Let’s get began.

How one can Turn out to be Wealthy Past Your Goals in 15 Steps

#15. Set Objectives

Essentially the most profitable individuals set objectives.

Not solely do they know what they need out of life, they develop the steps to get there.

Don’t assume this can be a course of that takes a variety of work.

You simply have to know what you need after which work backward.

For instance, let’s say your aim is to have $1 million {dollars} in 25 years.

To succeed in this aim, your first step is to interrupt it down.

If we divide $1 million by 25, we get $40,000.

So, we have to save roughly $40,000 a 12 months.

This isn’t utterly correct, although, as a result of as your financial savings and investments earn compound curiosity, you’ll have to save much less.

However to maintain issues easy, let’s simply go along with this quantity for now.

The following step is to determine how you will put away $40,000 a 12 months.

This could possibly be reducing bills, beginning a aspect hustle, and so forth.

We are going to dive extra into this half shortly, however for now, concentrate on creating some objectives you need to obtain.

And don’t simply concentrate on monetary objectives right here, both.

Any aim that can assist you be higher must be included right here.

The ultimate a part of the aim making course of is to maintain monitor of your progress to be sure to aren’t falling behind.

#14. Develop A Wealth Mindset

This subsequent step ties in with the earlier one.

You may take a look at attempting to save lots of $40,000 and assume it’s not possible.

That is the place your mindset comes into play.

All of us have a cash mindset.

Some have a poor mindset, whereas others have a wealth mindset.

Whichever your typical thought patterns are about cash is how your life is popping out.

If you’re uncertain which one you might have, take a look at your present monetary well being to determine this out.

For instance, you probably have a shortage mindset, you will have a tough time constructing wealth.

You’ll all the time be occupied with how little you might have and the way, whenever you do get some money, one thing is there to take it away.

If in case you have an abundance mindset, it is possible for you to to develop wealth a lot simpler.

It’s good to be grateful when cash comes into your world and consider that it all the time will.

| Progress Mindset | Shortage Mindset |

|---|---|

| Perception in Studying and Enchancment | Worry of Shedding or Falling Behind |

| Focuses on effort and studying from failure | Avoids dangers on account of concern of failure |

| Embraces challenges as alternatives | Sees challenges as threats or obstacles |

| Believes expertise and intelligence can develop | Believes skills are mounted and restricted |

| Open to suggestions and constructive criticism | Defensive and proof against criticism |

| Celebrates others’ success | Envious or threatened by others’ success |

| Persistent within the face of setbacks | Simply discouraged by setbacks |

I’ll admit having the fitting cash mindset doesn’t come naturally to some individuals.

So it’s a must to work at it.

Utilizing cash affirmations is a good first step.

From there, it’s all about being grateful every day for what you might have and what’s but to return.

#13. Reside Beneath Your Means

I do know, nothing groundbreaking right here.

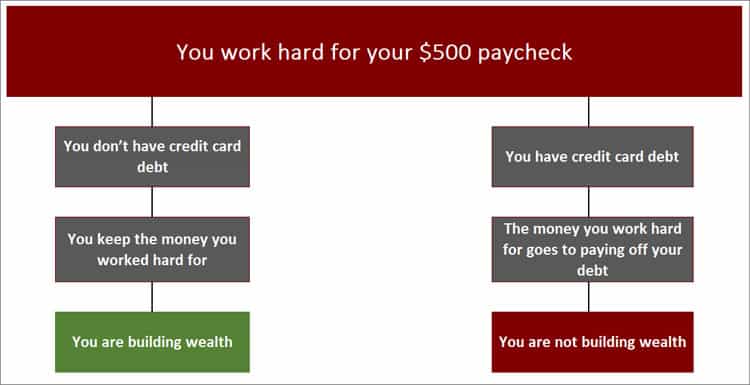

However in order for you any shot to get wealthy, you’ll be able to’t be in client debt.

If you end up, you’re working to pay different individuals and never your self.

Take into consideration that for a minute.

If you’re in $500 value of bank card debt and also you receives a commission $500 per week after taxes, you simply labored 40 hours to get out of debt.

None of that cash you earned is yours. It’s going proper to the bank card firm.

It’s laborious sufficient to get away from bed some mornings and struggle site visitors.

If you’re in debt, you’re doing it just so you’ll be able to hand your paycheck over to another person.

That should change.

It’s good to get out of debt and begin residing inside your means.

But it surely doesn’t finish there.

Being in debt strangles your choices in life as nicely.

If you happen to had no debt and saved your spending in examine, you can work at a extra rewarding job and even receives a commission much less.

You’ll be infinitely happier since you could be doing one thing you like to do.

Your first step to constructing wealth is to get out of debt.

The query is, how do you go about getting out of debt the quickest?

Fortunately, I’ve detailed this info for you.

#1. First, it’s a must to see how a lot debt you might have and the place it’s.

Write down your present balances and what kind of debt it’s, like bank cards, scholar loans, and so forth.

You’ll want to listing the rate of interest you’re paying as nicely.

#2. The following step within the course of is to begin paying off your debt.

I want the debt snowball technique since it’s best at holding you motivated to repay your debt.

When you arrange your money owed and create a plan to comply with, you can begin paying off your debt and begin constructing wealth.

#3. Don’t turn into obsessed together with your mortgage.

Your mortgage is taken into account good debt, however this isn’t why I like to recommend towards paying it off early.

I consider you’re higher off investing your cash so it will probably develop sooner.

It’s because in case your mortgage charge is 4%, you’ll be able to earn 8% investing within the inventory market.

Why put your money right into a 4% funding when you’ll be able to earn double that quantity?

However it’s a must to be disciplined and really make investments the cash.

You additionally need to consider that investing is the higher possibility.

If you happen to actually hate debt and may’t stand the thought of getting a mortgage, then repay your mortgage as an alternative of investing.

Whereas mathematically you’re making a mistake, personally, you’re making the selection that makes essentially the most sense for you.

This is the reason private finance is private. What’s proper for me may not make sense for you.

With that stated, it’s a must to perceive the professionals and cons of your selections.

#12. Spend Good

One other consider changing into wealthy is to spend good.

What does this imply?

It means not solely keeping track of your spending, but additionally is about shopping for high quality gadgets, even when they value extra.

A fantastic instance is one I realized just lately.

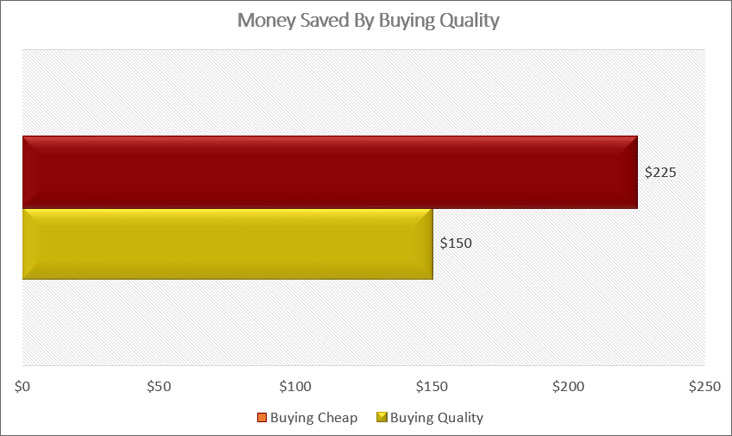

I are inclined to put on a variety of t-shirts.

Since I don’t worth them that a lot, I might go to a retailer and purchase their shirts for $9 every.

My considering was that $9 was a lot better than the $30, which one other retailer prices.

However my considering was flawed.

The $9 shirts have been made poorly.

I ended up needing new ones yearly as a result of they might get holes in them.

The $30 shirt, alternatively, was made higher and lasted a few years.

Over time, the $30 shirt is a greater purchase as a result of in 5 years, I’d solely purchased one shirt.

But when I purchased 5 low-cost shirts (a white one, a black one, blue, purple, and brown), in 5 years, I might spend $225 ($9/shirt instances 5 years instances 5 shirts).

And that’s simply with shirts.

Consider all of the instances you base your buy on value alone.

My guess is you can be saving a good quantity on dearer issues regardless that the upfront value is extra.

Granted, there are occasions when decrease priced is healthier.

For us, we purchase the shop model frozen greens. They style the identical and are less expensive in value.

Before you purchase something, take a look at the standard of the merchandise first.

See if it is smart to purchase the most affordable model or if a higher-priced one is a greater worth over the long run.

It is a secret wealthy individuals use on a regular basis.

They not often concentrate on simply the value. As an alternative, they concentrate on the worth.

Relating to keeping track of your spending, you are able to do this simply due to expertise.

For instance, you need to use the app BillTrim.

They are going to have knowledgeable negotiator attempt to decrease your payments two instances a 12 months.

They will even monitor your payments, and in the event that they see a value improve, they may attempt to get it lowered.

On common, customers save $900 a 12 months on their payments. And if BillTrim can’t prevent a minimum of $300, it’s free.

Click on the hyperlink under to strive BillTrim out and see how a lot you may be saving.

BillTrim

BillTrim is one of the best ways to decrease your payments. Make a one time fee and let BillTrim get to work, saving you cash. The common person saves as much as $900 a 12 months. And if BillTrim cannot prevent $300, you do not pay.

We earn a fee when you make a purchase order, at no further value to you.

Along with BillTrim, you’ll be able to take some easy steps to maintain your spending low.

I prefer to evaluate my spending, from giant to small, to maintain issues in examine.

By utilizing this strategy, you save essentially the most cash within the quickest manner within the least period of time.

Don’t make the massive mistake of letting this money sit in your checking account.

This ensures you’ll find one thing to spend it on, and the result’s you’ll by no means turn into wealthy.

#11. Observe Your Internet Value

Earlier, when speaking about objectives, I discussed that it is advisable monitor your progress all year long.

One nice technique to monitor your progress is to calculate your web value.

Your web value is just your property minus your liabilities.

It provides you an important perception into how you’re progressing in direction of your monetary objectives.

Along with your web value, I like to trace one different ratio.

I take a look at my annual revenue and my web value.

For my annual revenue, I take a look at line 9 on my Kind 1040 and divide that quantity by my web value.

Let’s say my annual revenue is $75,000 and my web value is $100,000.

I take $75,000 divided by $100,000 to get to 0.75 or 75%.

This tells me that my revenue is the same as 75% of my wealth.

The decrease this quantity, the higher.

For instance, let’s say 10 years later, my revenue is $80,000, and my web value is $900,000.

My ratio is now roughly 9%.

I’m relying much less and fewer on my revenue as my wealth grows.

#10. Know What Issues

Advertisers are good at getting you to half together with your cash.

If you wish to be a millionaire someday, it’s a must to know what issues to you.

In different phrases, develop some good habits.

This implies not getting sucked into the advertising for a product and shopping for on a whim.

Be sure to know who you’re and what you want.

It is a huge step in not falling for advertiser’s tips.

Sadly, you’ll nonetheless fall sufferer at instances. The important thing right here is to make as few poor monetary selections as doable.

All the pieces you need to purchase must be considered first.

Write it down, make an observation in your telephone, or do no matter.

Then wait per week and see when you nonetheless need it.

Odds are you received’t, and you should have utterly forgotten about it.

This trick works due to the way in which our mind is wired.

Our emotional aspect fires up first, which makes us purchase with out considering.

Then, someday later, our rational aspect kicks in.

We all know this occurs once we remorse a purchase order.

By writing it down, we give our rational mind an opportunity to course of the data and keep away from making an impulse purchase.

And here’s a bonus tip: when you find yourself not shopping for issues, take the quantity you’ll have spent and put it right into a financial savings account so it earns compound curiosity, and grows your wealth.

#9. Make investments Your Approach to Monetary Independence

You’ll by no means construct wealth except you make investments.

OK, you’ll be able to win the lottery, although unlikely, or get 1,000,000 greenback inheritance from a protracted misplaced uncle, once more, odds not so good there.

And sure, having a financial savings account is nice for a wet day fund, however you’ll by no means accumulate wealth by placing all of your cash right here.

However realistically, your finest shot is to put money into the inventory market.

I do know some studying this is able to quite stroll over scorching coals than make investments available in the market, however it isn’t so dangerous.

In actual fact, when you comply with the ideas I discuss in my investing posts, you’ll be a profitable investor.

Which means that over time, you’ll develop your wealth.

You need to concentrate on the next:

- Put money into a low-cost index fund. This may be both mutual funds or exchange-traded funds.

- Make investments regularly. It’s a good suggestion to take a position month-to-month. This creates a constructive behavior over the long run.

- Know your threat tolerance. Getting improper your consolation with threat is one of the best ways to destroy your wealth.

- Have a retirement account. The curiosity you earn is tax-deferred or tax-free, relying on the account.

From there, all that’s left so that you can do is to take a position.

You possibly can go about this one in all two methods: both DIY or rent a monetary advisor.

For a lot of, the DIY strategy works finest.

Don’t assume for a minute that you would be able to’t make investments by yourself.

Because of expertise, it’s simpler than ever.

All it is advisable do is know what your objectives is and this may provide help to to grasp the proper match for you.

If you happen to would quite simply have me suggest a web-based dealer, then you’ll be able to’t go improper with Acorns.

They’re an ideal possibility for most individuals as they automate 99% of the issues it is advisable do with the intention to generate income within the inventory market.

Plus, they can help you begin with as little as $10 (they usually allow you to make investments your spare change!)

In as little as 5 minutes, you’ll be able to have your account opened and Acorns will deal with all the pieces for you.

All it’s a must to do is sit again and let your investments develop.

Finest For Investing Small Quantities Of Cash

Acorns

Acorns modified the sport after they allowed you to begin investing your spare change. With a easy to make use of app and easy methods to take a position, Acorns is a strong selection for a lot of buyers simply beginning out with out some huge cash to take a position.

We earn a fee when you make a purchase order, at no further value to you.

If you happen to aren’t a DIY individual, you’ll be able to rent a monetary advisor.

Whereas that is an possibility, many received’t have the quantity of investable property most advisors require.

It’s because most advisors cope with individuals who have $250,000 or extra to place into the market.

This is the reason robo-advisors like Acorns got here alongside and are so nice.

They permit the little man to take a position and construct wealth via investing.

If you happen to do discover an advisor that you simply like, make sure they’re a fiduciary.

This can guarantee they’re investing in a manner that’s finest for you.

Sadly, not all advisors put your objectives first and, because of this, generate income off you.

Lastly, I need to discuss to you about find out how to arrange your investing technique.

Utilizing this information, you’ll cut back your taxes, permitting for extra compound development, which grows your financial savings sooner.

- #1. Begin investing in your 401k plan. Make investments as much as the employer match.

- #2. Open a Roth IRA. Put in as a lot because the IRS permits.

- #3. Contribute extra to your 401k plan. Ideally, you need to get to fifteen% contributions.

- #4. Put financial savings right into a taxable funding account. Begin investing in an everyday brokerage account.

By investing in tax advantaged retirement accounts first, you decrease your taxable revenue and defer or keep away from taxes on capital positive factors and dividends.

#8. Contemplate Actual Property Investing

Actual property investing is one other nice technique to construct wealth.

The largest draw back is it will probably take you a very long time to construct your financial savings.

However when you do that, you’ll be able to put wealth constructing on auto-pilot.

In fact, there may be an alternative choice to saving up 1000’s to purchase a property after which managing it or paying somebody to handle it for you.

You will get concerned with actual property crowdfunding.

This service has a bunch of buyers pool their cash to purchase properties after which earn a share of the earnings based mostly on their possession %.

The very best one I’ve discovered is Arrived.

You possibly can put money into single-family properties for as little as $100.

Then, you earn a quarterly dividend from the rental revenue based mostly in your possession share.

When the property is bought, you additionally earn a return on the appreciation.

It’s simple to get began with lots much less cash than you in any other case would wish.

Best Method To Make investments In Actual Property

Arrived Properties

Searching for a straightforward technique to get began investing in actual property with out some huge cash? Look into Arrived Properties. Decide the one household homes within the elements of the nation you need to put money into and earn passive revenue.

Begin Investing In Actual Property

We earn a fee when you make a purchase order, at no further value to you.

#7. Be A Lifelong Learner

I don’t care what your age is; it is advisable educate your self always.

We reside in a fast-paced world, and expertise adjustments on a regular basis.

If you happen to don’t keep on prime of evolving your talent set, you will get left within the mud.

Why does this matter?

As a result of you’re your best asset to changing into wealthy.

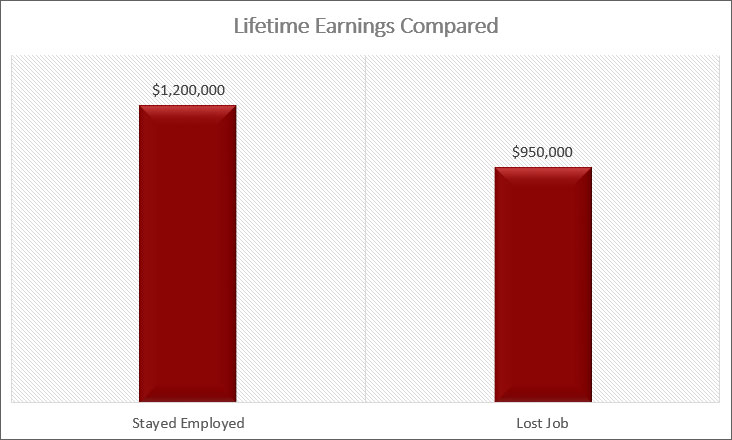

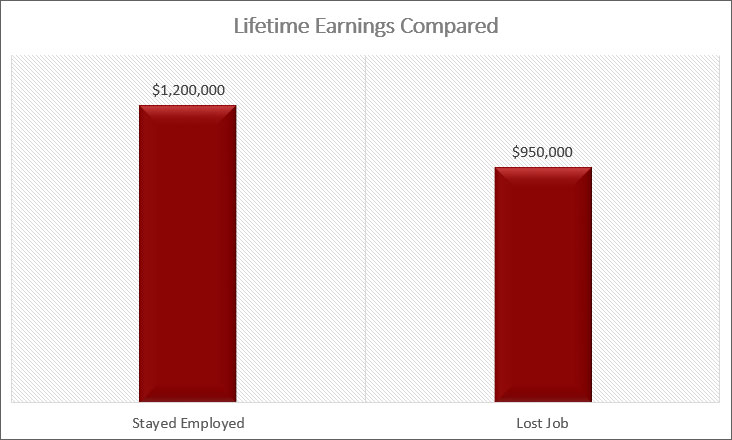

Nowhere else will you earn as a lot cash as you’ll be able to out of your profession.

For instance, if you’re making $40,000 a 12 months and are 35 years previous, you’ll make a complete of $1.2 million by age 65, assuming you by no means get a elevate.

If you happen to don’t continue learning, although, another person who’s hungrier for fulfillment will come alongside and put you liable to being let go.

If you happen to do get let go in 5 years, chances are high you should have a troublesome time discovering a comparable job since you haven’t stayed updated with expertise.

This implies you’ll have to take a lower-paying job.

If this new job solely pays you $30,000 you simply value your self $250,000 in lifetime earnings.

Subsequently, it’s important that you’re all the time getting further training about your business and ensuring you’re studying new expertise.

How do you do that?

Learn business magazines. Go to conferences and networking occasions. Have a look at what software program you utilize and see when you can turn into extra educated about find out how to use it.

The extra data and knowledge you devour, the higher your possibilities of holding your job, incomes raises, and changing into wealthy.

#6. Begin Your Personal Enterprise

Numerous monetary success comes from beginning your individual enterprise.

In actual fact, in keeping with a research, 88% of millionaires are entrepreneurs who began a small enterprise.

You don’t have to begin a franchise or have a ton of cash to begin a small enterprise.

In actual fact, the smaller you’ll be able to preserve it, the higher.

Once I did this, my very own enterprise was only a aspect hustle.

I used to be doing one thing on the aspect I loved, and it was bringing in some additional money.

I didn’t use this money for residing bills. I saved all the pieces.

Just a few years later, I used to be laid off, took an opportunity, and turned my aspect enterprise right into a full-time job,

Now I’ve different aspect hustles I do for additional money as nicely.

I don’t ever plan on making these a full-time job; I simply use them as additional revenue streams.

Right here is why that is essential.

When you might have a number of streams of revenue, you develop your wealth lots sooner.

You possibly can take your revenue out of your aspect enterprise and use it to spice up your financial savings.

Once I was doing this, I used to be making at most $10,000 a 12 months.

This isn’t lots, however after 3 years, I had over $30,000 in financial savings.

This was along with what I used to be saving from my common job.

The purpose is that it’s by no means a foul factor to have numerous revenue sources.

It lowers your threat when you have been to lose your job and it permits you to save much more cash.

#5. Work Exhausting

Together with being a lifelong learner is to work laborious. You possibly can’t simply skate by even when you keep on prime of the developments in your area.

It’s important to work laborious.

This implies getting lots completed. Tackle new tasks. Assist out anyplace you’ll be able to.

I’m not saying it’s a must to work 80 hours per week, although working 50 or 60 wouldn’t be a foul factor.

Along with placing in laborious work, discover methods to work good too. See if there are methods you’ll be able to enhance your time administration expertise.

I recommend you learn Getting Issues Performed. That is very true in case your emails are out of hand.

One other good time administration talent is to chop out distractions.

Shut your door on the workplace or block off time in your work calendar so others assume you’re busy and received’t hassle you.

Different choices embody:

- Solely examine your e mail twice a day, at set instances

- Use the Pomodoro Timer to focus for brief durations of time

- Get in to work early so you’ll be able to work uninterrupted

The higher you turn into at being environment friendly with the small day-to-day issues that eat away at your time, the extra time it is possible for you to to spend on different areas.

These embody tasks, discovering new companies, or anything that may make you stand out from the gang.

And this, in flip, will result in bigger raises and extra wealth.

#4. Turn out to be Worthwhile

Making a living isn’t solely about working laborious. It’s to learn to turn into invaluable at work.

By changing into invaluable to your boss and your organization, you reduce the specter of a layoff and earn extra money.

Simply how do you do that?

Your boss must see you as somebody the corporate can not survive with out.

To do that, create new methods of doing issues.

For me, it was all about velocity. In a single job I had, we handled Excel lots and it was all handbook work.

In different phrases, it’s actually boring stuff.

I ended up studying about Excel macro formulation and making use of them to my job.

All of the sudden, the work that may take me 8 hours I used to be getting completed in 3 hours.

The tradition of our complete division modified in a single day.

Now not have been we caught doing boring studies manually.

We now have hours of free time to concentrate on rising our division.

We even tried to determine different methods to automate a few of our different duties and have been profitable with a couple of.

One other technique to turn into invaluable is to do the work your boss hates.

Go into their workplace and ask them what they’ve been laying aside doing and when you can take it off their palms.

They are going to love you for this.

At one other job I had, my boss needed to write a quarterly market evaluate.

He hated doing this and would wait till the final minute to put in writing it.

He could be a bear all day due to how careworn he was.

I supplied to take the quarterly evaluate from him and he agreed. I used to be his go-to worker from that second on.

Lastly, you’ll be able to determine methods to save lots of your organization cash.

I’ve a pal that does this.

He’s so expert in it that he now will get a share of the annual financial savings as a bonus!

The extra you’ll be able to turn into invaluable, the better the probabilities you will note bigger wage will increase and decrease odds of shedding your job.

In actual fact, by following my recommendation on this article, you can earn annual raises of 5% or extra.

#3. Community

Some individuals don’t assume networking is essential, however it’s.

You by no means know when you have to the assistance of your community.

For instance, my spouse was coaching to turn into a life coach. In her program she wanted a sure variety of shoppers to begin with so she may keep in this system.

The deadline was getting shut and he or she was a couple of individuals quick.

I instructed that she submit on Fb and LinkedIn.

She has a ton of buddies on Fb and labored in gross sales beforehand so she additionally has a variety of LinkedIn contacts.

She posted in each locations on Sunday evening and by Monday morning had 5 individuals attain out to her with curiosity.

Networking is a strong software to have at your disposal.

The bigger your community, the extra choices you might have.

This might imply getting assist with one thing like discovering a job or simply getting assist with a mission you might have.

To get began networking, preserve it easy.

Attain out to some buddies you haven’t talked to shortly. Discover some shoppers of yours on LinkedIn and join with them.

Then discover previous colleagues which have moved on and join with them as nicely.

Make it a degree to attach with individuals you meet at networking occasions on LinkedIn as nicely.

As time goes on, you need to be capable to construct a strong community.

Simply remember to be in contact with them often, both via e mail or assembly for lunch.

#2. Marry Good

Yep, I needed to embody this one on the listing. The reason being easy.

Marriage could make or break your possibilities of ever changing into wealthy.

If you happen to marry good, you’ll work as a staff and develop your wealth over time.

If you happen to marry the improper individual, you’ll be at odds the entire time and can destroy your wealth.

To be extra particular, it’s a must to marry somebody who has the identical values as you.

I do know that opposites appeal to, however life and marriage are a lot simpler when you find yourself each on the identical web page concerning the huge issues.

This consists of household and cash.

Some individuals are savers, and a few are spenders.

If you wish to obtain monetary independence and your partner needs a brand new automobile each 2 years, you will have points.

However when you each have a aim of wealth, you’re employed collectively and obtain this aim.

If you happen to do find yourself marrying somebody with values totally different from yours, there may be one other manner you’ll be able to destroy your wealth.

You’ll struggle the entire time and infrequently save something.

Ultimately, the wedding will finish in divorce, and any cash you save will get cut up 50/50.

So when you had 1,000,000 {dollars}, now you solely have $500,000.

You simply misplaced half of your wealth by marrying the improper individual.

From there, you should have a good more durable time working to turn into wealthy as a result of you could have to pay alimony and little one assist.

I notice that not all marriages finish due to funds alone, however it’s a must to be sure to are marrying the fitting individual.

#1. Change And Adapt

The ultimate step within the technique of changing into rich is to alter and adapt.

My thought of wealth is totally different now than 15 years in the past.

It is a key level in changing into a millionaire.

It’s important to change and adapt with the instances.

Again then, I wished tons of stuff and would have wanted tens of millions simply to purchase the issues I wished.

Then, I might have wanted many tens of millions extra simply to afford the maintenance on all the pieces.

This is the reason so many individuals find yourself destroying their funds.

They solely take into consideration needing the tens of millions to purchase all the pieces they need.

They by no means take into consideration the continuing prices and the way this requires them to maintain incomes tens of millions yearly going ahead.

I notice now that I may be rich and have lots much less stuff and because of this, I don’t want as a lot cash.

This helped me to chop spending with out even attempting.

I encourage you to not maintain on to your particular thought of wealth.

Let it change as you develop. Almost certainly, you’ll find the identical factor I did.

That in time, experiences are extra invaluable than issues.

Closing Ideas

There you might have the 15 steps to changing into rich and reaching monetary independence.

If you’re severe about changing into a millionaire, these are the steps it’s a must to comply with.

From constructing a nest egg and a funds to investing constantly so you’ll be able to profit from compound curiosity, all this stuff add as much as lifelong wealth when you comply with them.

And when you turned your dream right into a actuality, then you’ll be able to sit again and loosen up and benefit from the wealth you constructed up.

I’ve over 15 years expertise within the monetary companies business and 20 years investing within the inventory market. I’ve each my undergrad and graduate levels in Finance, and am FINRA Collection 65 licensed and have a Certificates in Monetary Planning.

Go to my About Me web page to study extra about me and why I’m your trusted private finance professional.