Cyber danger is inevitable. In at the moment’s enterprise atmosphere, the purpose shouldn’t be to eradicate danger, however reasonably to handle it as effectively as doable. Two major approaches are remedy by deploying cyber controls and altering person behaviors, and switch by way of cyber insurance coverage. These approaches are interconnected: robust controls decrease danger which facilitates entry to protection, whereas weak controls enhance danger, making inexpensive insurance policies tougher to acquire.

At present we’ve got revealed a brand new report that explores this relationship in depth. Primarily based on an unbiased survey of 5,000 IT leaders it appears to be like at cyber insurance coverage adoption amongst mid-market organizations, highlighting buy drivers, the affect of protection investments on insurability, and the explanation why cyber incidents prices aren’t all the time lined in full.

Govt abstract

Within the face of inevitable cyberattacks, adopting a holistic method to cyber danger administration that takes benefit of the interaction between cyber defenses and cyber insurance coverage will allow organizations to decrease their general whole value of possession (TCO) of cyber danger administration whereas lowering their probability of experiencing a significant incident.

The analysis additionally reveals that investing in cyber defenses not solely makes getting insurance coverage simpler and cheaper but additionally improves safety and reduces IT workload. This discovering additional emphasizes the significance of contemplating cyber danger investments holistically, reasonably than as particular person parts.

One space of concern highlighted by the survey is the potential for coverage purchases to be misaligned to enterprise wants. Cyber insurance coverage is an funding, so insurance policies should cowl the proper dangers. All stakeholders, particularly IT and cybersecurity groups, needs to be concerned in selecting insurance policies to make sure they meet the group’s wants.

Adoption of cyber insurance coverage is widespread

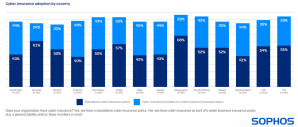

The survey confirms that adoption of cyber insurance coverage is widespread amongst organizations with 100-5,000 workers, with 90% of organizations having some type of cyber protection. 50% have a standalone coverage whereas 40% have cyber as a part of a wider enterprise insurance coverage coverage, resembling a common legal responsibility coverage. Adoption ranges are excessive throughout all 14 international locations surveyed, with Singapore reporting the best propensity to have protection.

Basic consciousness of the enterprise affect of cyberattacks is the commonest motive behind insurance coverage adoption

Organizations undertake cyber insurance coverage for a number of and numerous causes, with practically half (48%) citing consciousness of the enterprise affect of cyberattacks as the first motivator. 45% reported it was a part of their cyber danger mitigation technique and 42% stated that they want cyber insurance coverage to work with purchasers or companions who require it.

Investing in cyber defenses to optimize insurance coverage place is frequent observe – and its working

97% of organizations that bought cyber insurance coverage final yr improved their defenses to optimize their insurance coverage place. Practically two-thirds (63%) made main investments, whereas 34% made minor ones.

These safety investments are paying off, because the survey discovered that almost each firm that invested in bettering their cyber defenses stated it had a optimistic affect on their cyber insurance coverage place (99.6%, 4,351 of 4,370 respondents).

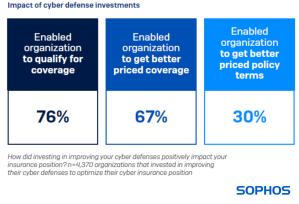

Cyber insurance coverage necessities are driving organizations to raise their defenses (the “stick”), with 76% of respondents saying their investments secured protection they couldn’t in any other case get hold of. The “carrot” is that two-thirds (67%) have been capable of get better-priced protection, and 30% acquired improved phrases due to their improved safety (e.g., increased protection limits).

Moreover, organizations investing in safety loved advantages past simply insurance coverage. 99% reported wider advantages resembling improved safety, fewer alerts and diminished IT workload.

Insurers virtually all the time pay out in some capability on a declare

Organizations which have invested in a cyber coverage shall be inspired to be taught that insurers virtually all the time pay out in some capability on a declare, with just one respondent saying their declare was absolutely rejected.

On the identical time, in 99% of claims insurers didn’t cowl the complete incident value. Total, insurers usually paid 63% of the overall incident value, with the modal payout charge coming in at 71-80%.

Causes for prices not being absolutely lined

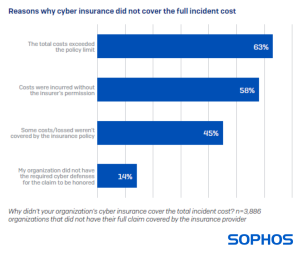

The survey additionally revealed that restoration prices from cyberattacks are outpacing insurance coverage protection. The most typical motive (63%) for the restoration invoice not being paid in full was whole prices exceeded coverage limits. In line with Sophos’ The State of Ransomware 2024 survey, restoration prices following a ransomware incident elevated by 50% over the past yr, possible leading to misalignment between insurance policies and bills.

There’s widespread uncertainty round what insurance policies cowl within the occasion of a cyber incident

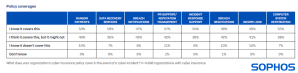

Many cybersecurity/IT leaders are uncertain about what their coverage covers within the occasion of an incident. Amongst these with a coverage, 40% assume it covers ransom funds, and 41% assume it covers revenue loss, however aren’t sure. These findings are trigger for concern on a number of fronts:

- Organizations danger not getting the protection they want – illustrated by 45% of these whose incident prices weren’t lined in full saying that some prices/losses weren’t lined by their insurance coverage coverage

- Organizations danger not getting the help they anticipate within the occasion of a declare

The dearth of visibility into coverage protection possible outcomes, no less than partly, from a disconnect between these buying the coverage and people on the frontline ought to a significant incident happen.

Learn the complete report

For extra detailed insights together with a take a look at the affect of cyber insurance coverage protection on ransomware outcomes, and lots of different areas, obtain the complete report.

In regards to the survey

The report is predicated on the findings of an unbiased, vendor-agnostic survey commissioned by Sophos of 5,000 IT/cybersecurity leaders throughout 14 international locations within the Americas, EMEA, and Asia Pacific. All respondents symbolize organizations with between 100 and 5,000 workers. The survey was carried out by analysis specialist Vanson Bourne between January and February 2024, and individuals have been requested to reply primarily based on their experiences over the earlier yr.