THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

There’s a whole lot of speak about investing in index funds and passive investing normally.

Some specialists say that is one of the best ways to construct wealth within the inventory marketplace for the common investor.

Others declare that you are able to do higher.

So how have you learnt if index investing is best for you?

On this put up, I focus on the ten greatest execs and cons of index funds.

By the point you end studying, you should have a strong understanding if this funding strategy is best for you.

10 Should Know Professionals and Cons of Index Funds For Success

Index Funds Professionals

There are a whole lot of advantages to index funds.

I’m highlighting the 5 greatest benefits that may have an effect in your wealth.

#1. Low Charges

Index funds, each mutual funds and trade traded funds, have traditionally been the bottom value investments.

In each instances, knowledgeable administration crew runs particular funds.

For a fund that’s not tied to an index, the supervisor and their crew analysis shares and actively purchase and promote holdings, making an attempt to maximise the shareholder’s return.

Clearly the individuals doing this work need to be paid, and they’re paid via administration charges, additionally referred to as the expense ratio.

This price is taken instantly from the annual return of the fund.

For instance, if you happen to put money into a mutual fund that fees a 1% price and it earns 8% this 12 months, you should have earned 7%.

Index funds even have a administration crew.

However the distinction is the holdings in these funds are tied to the index they’re copying.

There’s not constant shopping for and promoting making an attempt to maximise return.

The aim is to easily return what the underlying index earns.

Consequently, the bills charged by index funds are a lot much less.

The typical expense ratio energetic mutual funds cost is 0.76% whereas the common index fund fees 0.08%.

Right here is how this impacts your capability to develop your wealth.

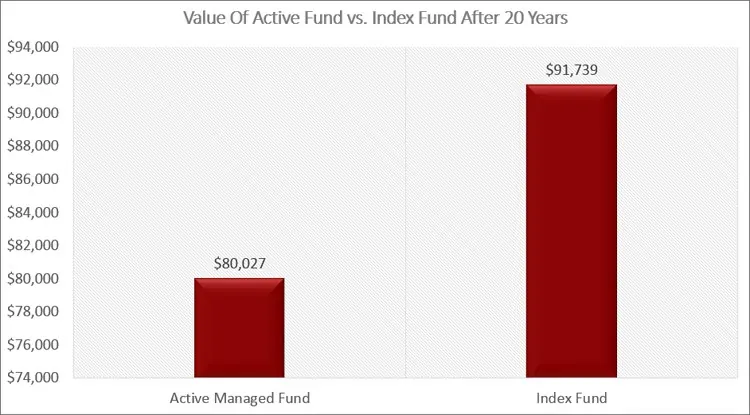

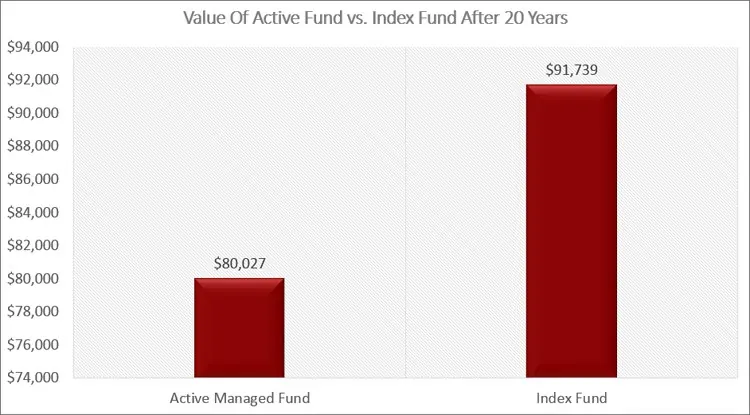

Let’s assume you make investments $25,000 in each an energetic mutual fund and an index fund for 20 years they usually each earn 8% yearly.

On the finish of the 20 years, the actively managed fund is value $80,027.

The index fund is value $91,739.

That may be a distinction of $11,712.

The decrease price allowed extra of your cash to remain invested and compound, which allowed it to develop into a bigger ending steadiness.

#2. Regular Returns

The aim of passive index funds is to earn what the market earns.

Whereas there are slight variations based mostly on how the fund is constructed, most will return inside 1% of the index they’re monitoring.

It is a profit as a result of you already know you earn will intently match the efficiency of the market.

With actively managed mutual funds, you by no means know what your efficiency could also be.

It’s all depending on how fortunate the administration crew is.

Be aware that I take advantage of the time period luck and never ability.

Whereas fund managers are extremely expert, they nonetheless can’t management what the market does.

They’ll really feel sure that just a few shares will develop in worth however this will likely not materialize.

Even essentially the most profitable fund managers hardly ever beat the market frequently.

Consequently, the fund may have subpar returns even when the market does effectively.

To drive this level dwelling additional, in 2019 solely 29% of actively managed fund managers beat the market.

This implies you had a 70% probability of incomes lower than what the market did.

Put one other means, if you happen to put money into index funds, your cash will develop greater than if you happen to invested in energetic administration funds.

And also you don’t get a discount within the price you pay when this occurs.

Don’t make the error many others make pondering {that a} increased price means higher market efficiency.

The 2 usually are not associated in any respect.

The underside line is, index funds are a wiser funding for a very long time horizon like retirement.

#3. Tax Environment friendly

Taxes have a serious influence in your long run wealth with the inventory market.

Some earnings, like bond earnings, is taxed at unusual tax charges.

And whereas long run capital positive aspects and dividends are charged a decrease tax price, the very fact is you continue to must pay taxes on these positive aspects and earnings.

Once you put money into actively managed funds, you’ll expertise a lot increased quantities of capital positive aspects on common.

It is because the managers are always shopping for and promoting the underlying shares.

With passive funds, managers usually are not doing a whole lot of promoting.

Consequently, the quantity of capital positive aspects you notice is far decrease, saving you cash on taxes.

#4. Simplicity Of Investing

Passive investing make investing within the inventory market easy, even for brand spanking new traders.

All it is advisable do is decide one or two indexes you need to put money into and discover a corresponding fund.

There is no such thing as a want for detailed evaluation or the necessity to rent a monetary advisor to regulate your funding.

By investing in an index fund, you put money into a lot of shares and you’ll know you’ll earn roughly what the market does, 12 months in and 12 months out.

That is good for new traders who can shortly grow to be overwhelmed on the many alternative investing choices.

You may get began investing with a comparatively low stage of threat, after which study extra as you go, figuring out within the meantime your cash is in an excellent funding.

#5. Comfort

In case you put money into particular person shares, it is advisable purchase a whole lot of totally different shares to be diversified.

This leads to you needing some huge cash.

The identical may be stated for a lot of actively managed funds as effectively.

For instance, if you happen to put money into a big cap progress fund, you’re solely spreading your threat amongst bigger, rising shares.

However with an index fund, just like the S&P 500 Index, you will have a extra diversified portfolio.

You not solely personal massive, rising shares, but in addition massive shares which might be thought-about worth shares.

Consequently, you may realistically be absolutely diversified in simply 1 or 2 index funds.

So don’t assume that by opting to take a position this fashion you’re limiting your self.

Associated so far is there are quite a few low value index funds so that you can select from.

5 Cons Of Index Funds

In fact there are some large disadvantages of index funds.

Listed below are the most important drawbacks it is advisable consider earlier than investing.

#1. No Flexibility

When the market is declining frequently, many energetic managers will regulate some holdings to restrict the losses you expertise.

Whereas they will by no means assure traders won’t ever lose cash, there are some choices the supervisor can take.

For instance, relying on the fund, they will shift cash from equities to bonds.

Or they will promote some holdings and transfer the proceeds to money in the meanwhile.

With passive investing nevertheless, this isn’t the case.

The supervisor is tied to retaining holdings in line that finest mimics the benchmarks they’re monitoring.

Consequently, if the market is dropping lots, you’re going to lose lots as effectively, assuming you’re investing in a fund tied to that index.

#2. No Massive Beneficial properties

Whereas it’s good to earn what the market returns, the very fact of the matter is you’ll hardly ever ever expertise an annual return of 30% or extra when indexing the overwhelming majority of time.

However with an energetic fund, you would see this return much more steadily.

In fact, you want to remember the purpose talked about above that energetic funds solely beat the market 29% of the time.

And the reverse is true too.

When the market drops, an energetic funding may lose extra money than the market, relying on its holdings.

#3. Danger Administration

Index investing doesn’t do an important job in danger administration.

What I imply is that almost all of indexes are made up of a selected standards.

The S&P 500 consists of the biggest 500 corporations.

The Russell 2000 Index is made up of two,000 small corporations.

The Dow Jones is made up of simply 30 corporations.

In case you put money into one in all these index funds, you miss out on a whole lot of different alternatives.

For instance, if you happen to put money into an S&P 500 Index fund, you don’t put money into small corporations or worldwide corporations.

With a view to unfold your threat, it is advisable put money into just a few totally different funds or discover a fund that invests within the whole inventory market.

And even with this strategy, if you wish to put money into each shares and bonds, you would possibly have to put money into a inventory ETF and bond funds individually.

#4. Focus of threat

One other situation with index investing is focus of threat.

A few of the inventory index funds are market cap weighted. The entire underlying shares wouldn’t have equal weight.

Here’s what this implies.

Let’s say you purchase a field of 64 crayons.

Within the field, 25 crayons are blue, 15 are crimson, 10 are inexperienced, and the remaining 14 crayons are every a distinct coloration.

In case you paid $10 for this field of crayons, a method to take a look at it’s that since 39% of the crayons are blue, $3.90 of your cash (39%) goes in the direction of blue crayons.

Following this similar logic, $2.34 buys crimson, $1.56 buys inexperienced, and the remaining colours are $0.16 every.

In an index fund, the identical factor occurs.

The vast majority of your cash goes in the direction of the biggest holding within the index, concentrating your threat disproportionately.

#5. Lack Of Publicity To New Developments

This one is arguably the most important disadvantage of index funds.

Once you put money into these funds, you’re caught with the underlying funds that make up the index.

Within the case of the S&P 500 Index, you’re investing in 500 of the biggest corporations.

When new tendencies emerge, the businesses are usually smaller companies this funding doesn’t maintain.

In the course of the emergence of latest tendencies is when many of the positive aspects are made within the firm inventory.

So by investing in sure index funds you miss on these funding alternatives until a bigger firm is concerned or buys out the smaller firm.

In different phrases, your portfolio lacks full diversification if you happen to solely put money into an funding that solely covers a sure sector of the market.

To beat this, you would need to take a look at the varied sectors of the market you need publicity to after which unfold your cash round these holdings.

Ultimate Ideas

On the finish of the day, investing in index funds is smart for almost all of particular person traders on the market.

The one individuals who it doesn’t make sense for are those that have a ardour for researching shares and actively buying and selling.

However even then, there isn’t a requirement that you must decide one or the opposite.

You’ll be able to cut up your funding {dollars} between actively managed funds and index funds.

This can can help you get the advantages of each worlds.

Simply ensure you are conscious of index funds execs and cons so you already know what you’re investing in.

I’ve over 15 years expertise within the monetary companies business and 20 years investing within the inventory market. I’ve each my undergrad and graduate levels in Finance, and am FINRA Collection 65 licensed and have a Certificates in Monetary Planning.

Go to my About Me web page to study extra about me and why I’m your trusted private finance professional.