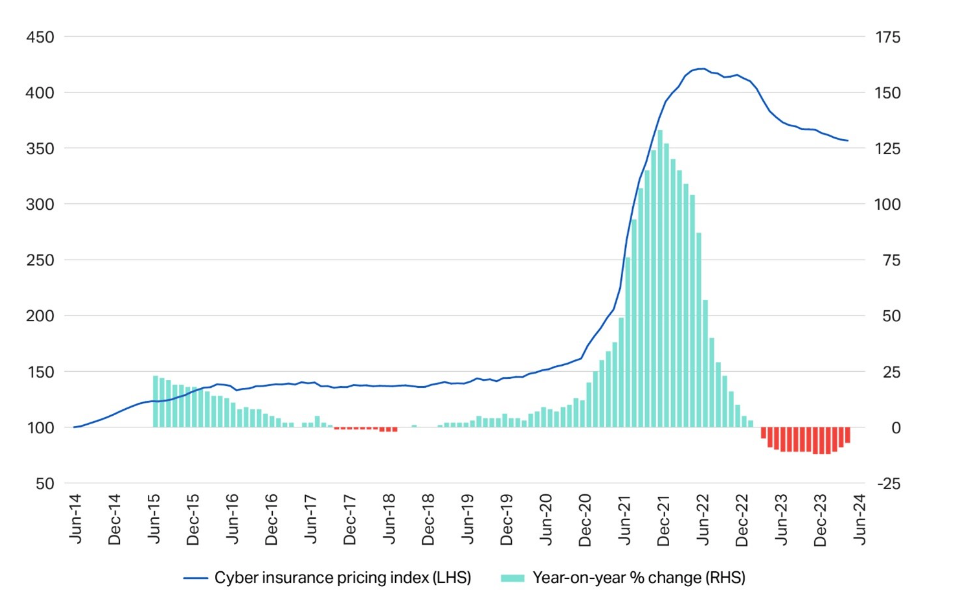

Improved cyber hygiene amongst companies has led to a discount in cyber insurance coverage premiums by 15% worldwide over the past two years, a new report from Howden Insurance coverage Brokers has discovered. That is even supposing cyberthreats, notably ransomware assaults, have gotten extra prevalent.

Consciousness of cyber hygiene practices, like multifactor authentication, EDR and cloud backups, has grown considerably since 2022.

Ransomware assaults have elevated by 18% this yr, in keeping with Howden and NCC Group, however efficient danger controls have lowered the necessity for corporations to pay ransoms. Nonetheless, restoration prices at the moment are on the rise once more after a short decline in 2022.

Insurance coverage premiums skyrocketed in 2021 and 2022 because the COVID-19 pandemic compelled corporations to hurry their transitions to distant work. Menace actors actively exploited new community vulnerabilities that resulted from using private gadgets, elevated entry factors and lack of centralised knowledge controls, resulting in extra claims.

Sarah Neild, head of cyber retail U.Okay. at Howden, defined why the price of cyber insurance coverage has declined. She advised TechRepublic in an e mail, “Elevated danger consciousness off the again of persistent and high-profile assaults is one cause.

“Insurers mandating minimal hygiene ranges for companies as a way to entry capability has additionally had a serious influence.” Fewer claims are being made in consequence, so insurance policies are getting cheaper.

Neild added, “The appreciable funding burden on corporations however, it has helped to instil a lot wanted resilience for policyholders. That is now paying dividends as they navigate a quickly shifting risk atmosphere.”

The Howden knowledge additionally confirmed that the variety of oblique claims from third events not deliberately focused in a cyber incident has been decrease than direct claims on common, additional indicating that corporations are successfully managing their dangers and mitigating losses.

Competitors between insurers is rising, too, as an increasing number of provide cyber insurance coverage insurance policies, serving to to drive costs down for patrons, the report said.

“Beneficial dynamics have persevered into 2024, with the price of cyber insurance coverage persevering with to fall regardless of ongoing assaults, heightened geopolitical instability and the proliferation of Gen AI,” Neild mentioned in a press launch.

“At no different level has the market skilled the present mixture of situations: a heightened risk panorama mixed with a steady insurance coverage market underpinned by sturdy danger controls.”

The Howden report additionally discovered that demand for cyber insurance coverage in Europe is prone to develop within the subsequent few years. Penetration ranges within the area are presently low, however consciousness of cyber dangers and strategic safety investments are rising. Small and medium organisations are additionally an underserved market.

Neild mentioned she expects the low costs to proceed. Nonetheless, they’re unlikely to drop any additional. She advised TechRepublic, “Present dynamics — provide vs demand, sturdy competitors and many others. — recommend consumers will proceed to learn from beneficial situations. Capability is up and the current sturdy efficiency of the market factors to the price of cowl being commensurate with loss prices.

“That mentioned, we’re already seeing value decreases reasonable following high-profile assaults within the first half of 2024, within the healthcare sector specifically. We subsequently anticipate market situations to stabilise from right here and are available to a touchdown level that gives a gorgeous long-term proposition for each consumers and carriers.”

Why cyber insurance coverage is turning into extra necessary to companies

Cyber insurance coverage will help companies stand up to the prices related to a profitable cyberattack or penalties for breaching more and more rigorous compliance laws. Information breach prices rose to $4.45 million per incident in 2023, in keeping with IBM, partly as a consequence of the truth that it was taking longer to analyze breaches.

A report from Splunk printed final month discovered the primary explanation for unplanned downtime throughout the world’s largest corporations was cybersecurity-related human errors, similar to clicking a phishing hyperlink. Downtime total prices them $400 billion a yr, or roughly 9% of their earnings.

Downtime from a cybersecurity incident instantly ends in monetary losses by way of misplaced income, regulatory fines and extra time wages for employees rectifying the difficulty. The report additionally unveiled hidden prices that take longer to have an effect, like diminished shareholder worth, stagnant developer productiveness and reputational harm.

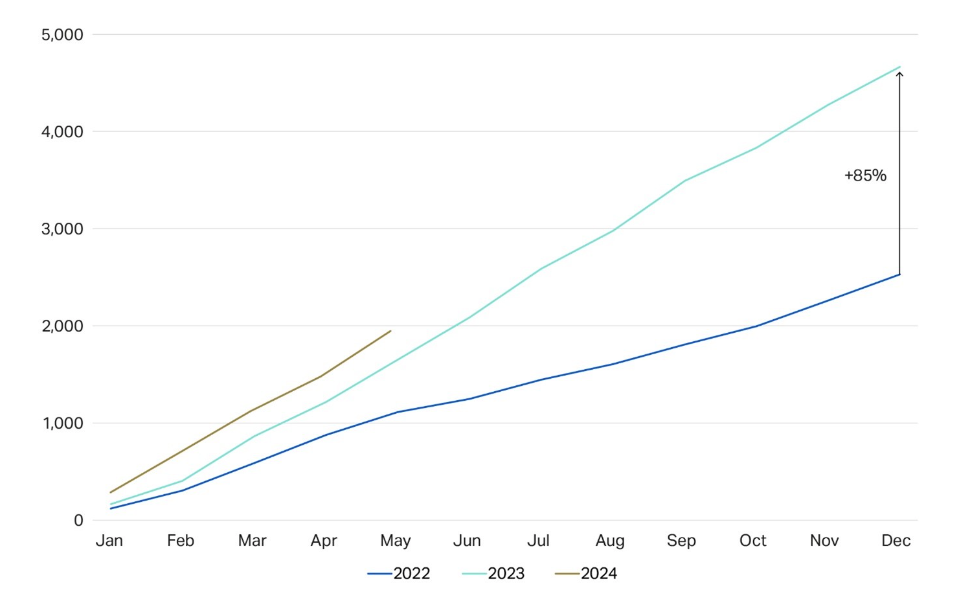

Along with the rising related prices, cyberattacks are additionally turning into more and more profitable. In April, a examine by Kaspersky discovered the variety of gadgets contaminated with data-stealing malware elevated by seven instances between 2020 and 2023. Final month, insurance coverage dealer Marsh revealed that they had acquired greater than 1,800 cyber claims from North American shoppers in 2023, a file excessive, as a consequence of corporations being struck by ransomware.

SEE: 87% of UK Companies Are Unprepared for Cyberattacks

Regardless of this, there’s proof that corporations are enhancing their defences in opposition to cyberattacks. In response to a 2024 report from Mandiant, the median dwell time — the period of time attackers stay undetected inside a goal atmosphere — of world organisations decreased from 16 days in 2022 to 10 days in 2023 and is now at its lowest level in additional than a decade.