Looking for Alpha and The Motley Idiot each supply in depth funding concepts for particular person shares. Both service may also help you grow to be a greater investor with free and premium analysis.

Nonetheless, one platform could be a greater match on your funding technique than the opposite. My Looking for Alpha vs. The Motley Idiot comparability may also help you determine which one is right for you as I share my insights as a subscriber to each companies.

How the Companies Work

When evaluating these two platforms, understanding the fundamentals is essential. Right here’s a breakdown of how every service works.

Looking for Alpha

Looking for Alpha options bullish and bearish funding commentary from unbiased authors with investing expertise. I feel it’s finest if you wish to analysis a number of shares and ETFs as a substitute of ready for the analyst workforce to furnish inventory picks and being restricted to a mannequin portfolio.

The service additionally publishes a number of complimentary newsletters that spotlight the most recent inventory market information and funding developments. These articles cater to many funding methods, together with short-term buying and selling and long-term holds.

It’s doable to learn a restricted variety of free articles every month, however a paid membership is important for limitless entry.

A Looking for Alpha Premium membership supplies instruments like:

- Unique inventory rankings

- A portfolio tracker

- 10+ years of economic experiences and earnings transcripts

- A inventory screener

Paid subscribers can even comply with authors, obtain member-only funding suggestions and get a mannequin portfolio.

Be taught Extra: Looking for Alpha Assessment

The Motley Idiot

The Motley Idiot publishes free every day articles in regards to the inventory market and single shares and funds. You may learn many articles totally free with out a month-to-month restrict.

Like most funding analysis companies, in-depth analysis and the very best funding concepts could be present in premium newsletters.

Companies similar to The Motley Idiot Inventory Advisor present two month-to-month inventory picks. You may also view the mannequin portfolio and the funding efficiency of earlier suggestions. The screener helps you to kind concepts by cautious, reasonable, and aggressive danger technique.

Whilst you can simply discover a number of funding concepts from the free and premium analysis, the content material focuses on a long-term “purchase and maintain” funding technique. The Motley Idiot inventory picks have a mean holding interval of three and 5 years.

This platform additionally publishes private finance content material that can assist you be taught extra about retirement and different monetary selections apart from investing.

Be taught Extra: Motley Idiot Assessment

How Motley Idiot and Looking for Alpha Are Related

Each platforms present these options to assist analysis shares shortly.

Investing Concepts

You’ll find long-term funding concepts, primarily for shares. Each platforms additionally supply protection for ETFs.

The articles and analysis experiences spotlight progress shares in these asset courses:

- Banking

- Client staples

- Insurance coverage

- Power

- Tech

- Medical

- On-line retail

- Valuable metals

- Actual property

- Transportation

Each companies use elementary evaluation to investigate potential investments.

Mannequin Portfolios

A paid subscription with both service may also help you view mannequin portfolios for a specific funding technique. These concepts can streamline your analysis course of and supply targeted funding concepts.

For instance, a paid service specializing in established large-cap corporations might keep away from shares that could be too unstable on your danger tolerance however can attraction to aggressive buyers.

The Motley Idiot follows a extra conventional publication publication strategy by providing a number of companies with month-to-month inventory picks. I like this strategy for those who don’t have time to analysis or need hands-on insights.

You may be a part of one or a number of newsletters for a yearly price to entry new month-to-month suggestions and an inventory of foundational shares that may be a superb purchase anytime.

Looking for Alpha theoretically supplies extra subscription alternatives as many authors have a portfolio and unique concepts behind the paywall. You may comply with a number of authors together with your premium subscription.

Podcasts

You may take heed to free investing podcasts to assist cowl extra floor for those who want one thing to take heed to when you commute, train, or backyard.

The Motley Idiot Cash and Looking for Alpha’s Wall Road Breakfast are the flagship productions for every service. Every every day podcast evaluations the most recent market headlines and will present an evaluation of particular shares and funds.

Each platforms additionally supply weekly podcasts about targeted methods. Plus, after listening to a podcast, you’ll be able to search the respective website for in-depth commentary.

Search Capabilities

You may search both platform by firm identify or inventory image to search out analysis when constructing a inventory watchlist.

Along with studying the most recent protection, you can even dig up outdated articles to gauge the accuracy of the creator’s opinion. These articles can even assist you to be taught extra in regards to the potential funding.

Every service additionally has a inventory screener to filter shares by particular rankings.

Listed here are the search capabilities obtainable to subscribers:

| The Motley Idiot | Looking for Alpha | |

| Search Bar | Lists free and premium analysis articles plus supplies fundamental monetary knowledge | Shows current articles, monetary historical past and rankings |

| Inventory Screener | Filter beneficial shares on your energetic publication subscriptions(Paid members solely) | Consists of shares and funds with Looking for Alpha and creator rankings |

| Portfolio Tracker | “My Watchlist” helps you to observe the efficiency of present holdings and potential investments(Paid members solely) | Observe the efficiency and rankings of your present holdings |

Each companies allow you to carry out fundamental analysis, together with researching the inventory value historical past and monetary valuation. A paid subscription is important to view in-depth evaluation and rankings.

How Motley Idiot and Looking for Alpha Are Completely different

Whereas they’ve similarities, every platform has some variations that may make one higher than the opposite relying in your funding analysis wants.

How Companies are Provided

These companies supply funding concepts in numerous methods. Right here’s how they differ.

Mannequin Portfolios

Looking for Alpha doesn’t reasonable mannequin portfolios like most funding newsletters. As an alternative, you should normally comply with a sure creator and await their commentary.

The Motley Idiot has specialised mannequin portfolios for each paid publication. Nonetheless, you should pay a separate annual price for every premium service.

Analysis Articles

Whereas the analysis high quality is analogous between companies, the funding commentary might attraction to totally different buyers.

For instance, The Motley Idiot articles usually are extra informal and are for long-term buyers. Consequently, they might be higher for newer buyers and people who choose fundamental particulars.

Looking for Alpha articles are extra skilled, which skilled buyers might choose. These articles can even present technical particulars and current a bullish and bearish case. Its analysis is extra in depth since there’s protection for almost each publicly-traded inventory and lots of ETFs.

Inventory Scores

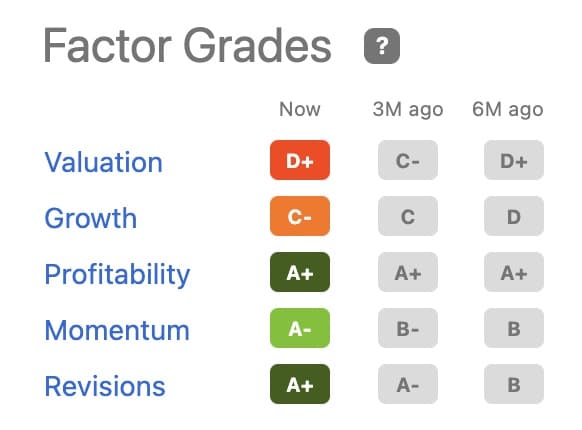

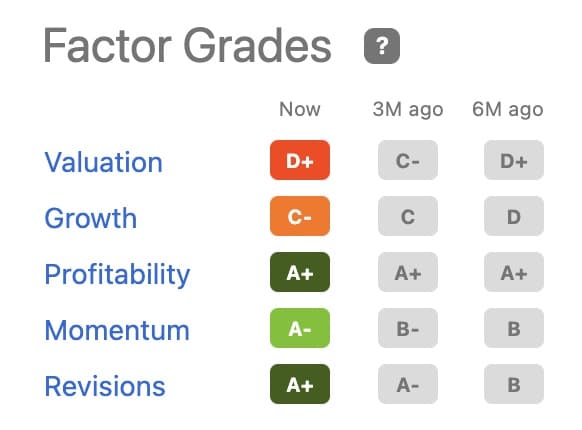

Trying past the articles, Looking for Alpha provides extra in depth rankings. For instance, you’ll be able to view creator rankings, Wall Road analyst rankings, and the Looking for Alpha Quant Scores to assist determine if a inventory has bullish, impartial or bearish funding potential.

The Motley Idiot solely supplies purchase, maintain or promote rankings for shares inside its paid newsletters. Inventory suggestions even have quant evaluation scores to estimate a good valuation. Sadly, you gained’t see rankings for corporations not in its mannequin portfolio.

Neither service supplies particular person funding recommendation.

Contributors

One other key distinction is how every platform sources its content material from authors and presents funding suggestions.

Looking for Alpha

Looking for Alpha is extra diversified and has quite a few contributors to the net group. For instance, readers might want to discern whether or not the creator is bullish or bearish and their funding methodology.

A number of authors additionally weave technical evaluation into their commentary and will point out goal buying and selling costs. You may comply with a selected inventory or creator to keep away from redundant commentary.

Consequently, Looking for Alpha could be higher for those who like the varied number of funding opinions.

The Motley Idiot

The Motley Idiot makes use of employees writers for its premium newsletters. Unbiased contributors generate free content material, however authors don’t charge shares or supply a mannequin portfolio.

Writers keep away from nitty-gritty pricing particulars similar to “purchase as much as costs” and cease losses to stop market timing. As an alternative, every article adheres to the buy-and-hold funding philosophy.

So long as you keep a long-term funding outlook, The Motley Idiot’s content material can have fewer competing voices. Whereas it may be more durable to search out bullish and bearish opinions, you may have a simple path for studying about an organization.

Funding Philosophy

Each retailers cater to long-term buyers who wish to maintain shares for at the very least one 12 months earlier than promoting. Nonetheless, there are some nuances between the funding methods.

Looking for Alpha authors might encourage a shorter funding interval to maximise market momentum for a selected inventory or asset class. Nonetheless, the technique could be totally different for every contributor.

The Motley Idiot recommends shares they imagine will beat the inventory market over the following three to 5 years. This service doesn’t use cease losses or buying and selling value ranges to enter or exit a commerce.

Value

The premium companies for both firm are competitively priced if you need an entry-level publication or a complicated service.

Free Trial

One distinction between each companies is the risk-free trial interval.

The Motley Idiot provides a 30-day refund interval on entry-level publications, however you should buy an annual subscription upfront. There isn’t a month-to-month fee plan obtainable.

Then again, Looking for Alpha Premium provides a one-month trial interval for $4.95 earlier than paying the total annual price.

The Motley Idiot

The Motley Idiot has many various newsletters you can buy.

Listed here are the annual costs for the platform’s newsletters:

| E-newsletter | Annual Price | Key Options |

| Inventory Advisor | $99 for the primary 12 months after which $199 yearly | Flagship service analyzing large-cap progress shares Two month-to-month suggestions Month-to-month updates of the ten Prime-Ranked Shares |

| Epic | $499 | Recommends high-growth shares with extra volatility and dividend shares for a balanced danger tolerance 5 month-to-month suggestions Quant Projections 10 finest concepts replace quarterly Urged $50,000+ portfolio dimension |

| Epic Plus | $1,999 | 9 month-to-month picks Recommends choices trades Proprietary AI investing portfolio backed my The Motley Idiot’s personal money Urged $100,000+ portfolio dimension |

Looking for Alpha

Looking for Alpha provides a number of paid plans that present totally different member advantages. You may pay month-to-month or buy a reduced annual subscription.

Right here’s a breakdown of Looking for Alpha’s pricing:

| Plan | Price | Key Options |

| Premium | $269 yearly (Usually $299) | Limitless article entry Observe creator rankings and efficiency Inventory Quant Scores 1-month trial for $4.95 |

| PRO | $2,400 yearly ($99 for the primary month) | Unique funding concepts Further analysis instruments Weekly emails VIP customer support No adverts |

Buyer Service and Expertise

Help choices could be a large issue when selecting between two companies. Whereas every platform provides e mail and telephone assist in addition to boards, on-line tutorials, and FAQs, there are some key variations.

The Motley Idiot is a extra interactive platform, however Looking for Alpha has a concierge service of their Professional Plan. This offers them entry to buyer assist representatives who may also help with their wants.

Who Are They Greatest For?

These summaries may also help you select the finest funding website on your investing model.

Looking for Alpha

Take into account Looking for Alpha for those who choose open-ended funding analysis from quite a few creator backgrounds. It may be simpler to learn the bullish and bearish insights from a number of contributors.

The inventory screener and score instruments can present extra insights than your brokerage analysis instruments. These options assist present elementary and fundamental technical evaluation for almost any publicly traded inventory and fund.

The Motley Idiot

Lengthy-term buyers might discover The Motley Idiot the higher match as every inventory choose has a multi-year holding interval.

You may additionally choose this platform for those who discover the abundance of creator opinions and rankings at Looking for Alpha overwhelming. As an alternative, you obtain two month-to-month inventory picks and recurring portfolio updates for extra hands-on steering.

The decrease annual price may also be extra interesting for those who don’t want entry to the extra Looking for Alpha analysis instruments.

Associated: Motley Idiot Epic Assessment

Which is Greatest General?

When it comes right down to it, every service has its strengths and weaknesses. General, it’s a wash.

Take into account The Motley Idiot if you wish to primarily depend on the analyst workforce to suggest shares and have a long-term funding focus.

Self-directed buyers preferring in-depth evaluation of shares and funds outdoors the mannequin portfolio will profit extra from Looking for Alpha.

As well as, Looking for Alpha is healthier for those who’re pursuing a number of funding methods and are an energetic investor making common purchase and promote trades.

Rivals

If you happen to aren’t certain that Looking for Alpha or The Motley Idiot are the precise choices, these funding analysis platforms can even assist you to analysis funding concepts and observe your present portfolio.

Morningstar

A Morningstar Investor subscription helps you to learn analyst experiences for shares, ETFs, and mutual funds. This service is finest recognized for its Morningstar rankings for funds.

Further premium options embrace a portfolio analyzer and a inventory screener. Whilst you gained’t essentially have a mannequin portfolio, there are a lot of lists of top-rated shares and funds for numerous classes you can tailor in direction of your funding technique.

This service prices $34.99 month-to-month or $249 yearly with an upfront fee. You should utilize a 7-day free trial to make sure it’s the precise platform.

Be taught extra: Morningstar Investor Assessment: Is It Value It?

Zacks

Zacks Funding Analysis provides analyst experiences for a lot of shares and funds.

It’s the main funding analysis agency specializing in inventory analysis, evaluation and suggestions. Since 1978, they’ve offered unparalleled inventory analysis, evaluation, and suggestions to each novice and skilled buyers.

With almost 800,000 members, Zacks additionally supplies specialised perception from market consultants who present detailed steering on reaching monetary success in right this moment’s inventory market.

Zacks, utilizing its proprietary system – the Zacks Rank, has crushed the S&P by a mean of 25.08% over the past 33 years.

By analyzing earnings estimates, the Zacks Rank approximates the likelihood an organization will outperform the inventory market.

Buyers excited about a long-term technique will recognize the Focus Record. It highlights the highest 50 shares set to outperform the market over the following 12 months.

Each skilled merchants and newcomers can have entry to priceless instruments like valuation rankings, inventory screeners, and lots of different assets (each free and paid) to assist elevate their funding technique.

A Zacks Premium annual membership prices $249 per 12 months, however buyers are welcome to strive it for 30 days completely free.

Be taught extra: Zacks Premium Assessment: Is It Value It?

Verdict: Ought to You Use Looking for Alpha or Motley Idiot?

You could find many funding concepts utilizing Looking for Alpha or The Motley Idiot. The higher service for you is determined by which analysis instruments you need in addition to your funding model.

Looking for Alpha helps you to discover funding alternatives and pursue totally different funding methods. Nonetheless, The Motley Idiot could be higher for hands-on steering because you obtain specialised inventory picks.

No matter which choice you select, each Looking for Alpha and The Motley Idiot may also help you uncover new inventory concepts.